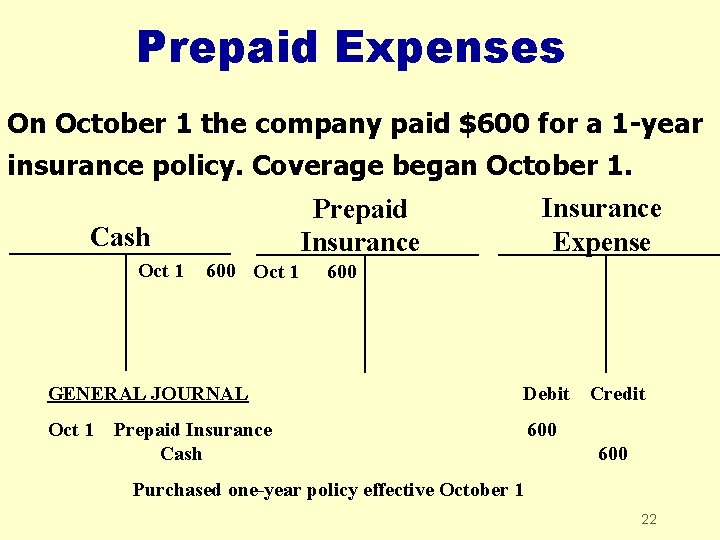

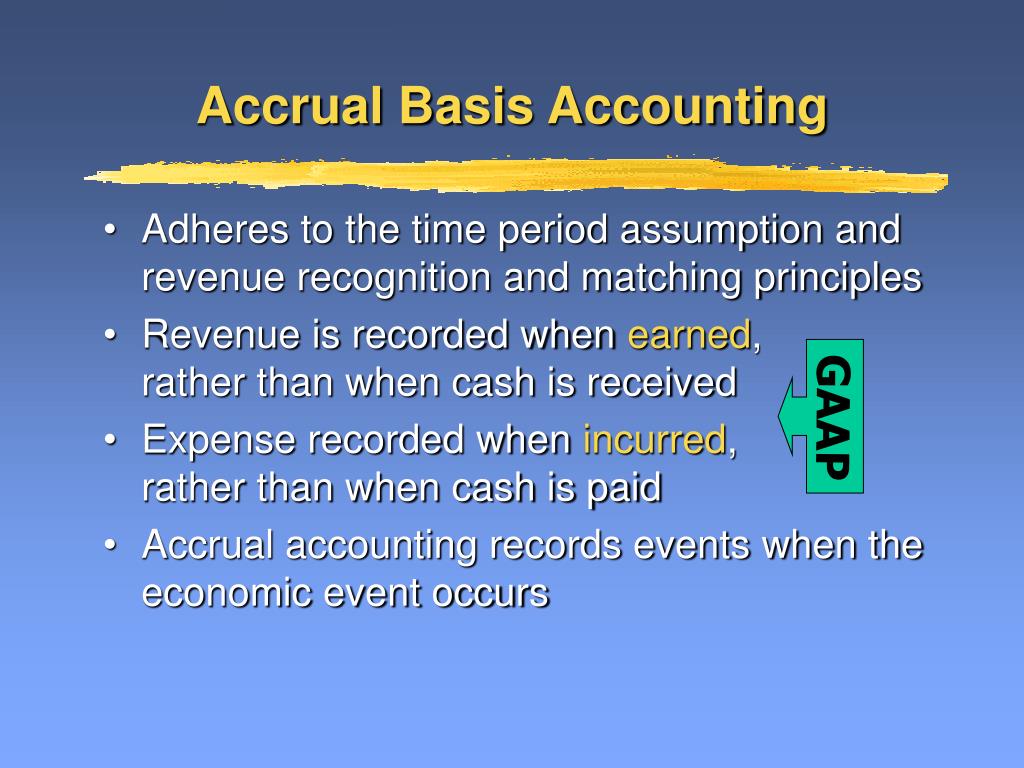

Prepaid expenses, such as insurance or rent paid in advance, are initially recorded as assets. As the benefits of these expenses are realized over time, adjusting entries are made to transfer the appropriate portion to the expense account. Unearned revenues, on the other hand, are payments received before services are rendered or goods are delivered. These are initially recorded as best tax software for expatriates in 2021 liabilities and gradually recognized as revenue through adjusting entries as the services are performed or goods are delivered. This process ensures that financial statements accurately reflect the timing of economic events, providing stakeholders with reliable information for decision-making. In contrast, cash basis accounting records transactions only when cash is exchanged.

- Consistency is a straightforward principle and is intended to enhance financial reporting by making it easier for users to make comparisons.

- However, while working on the project, ABC Company can accrue earnings or revenue for the work that is completed to date, even though billing for the project is not issued by PBC Company.

- For 2024, small business taxpayers with average annual gross receipts of $30 million or less in the prior three-year period can use it.

- For large corporations, accrual accounting isn’t just a choice — it’s often mandatory.

- As the benefits of these expenses are realized over time, adjusting entries are made to transfer the appropriate portion to the expense account.

Sign up for latest finance stories

Revenue derived from that service would be recorded in December when it was earned. Accounting standards require that revenues and expenses should be recognized when they have been earned or incurred. The historical cost of assets and liabilities will still be updated over time to depict accounting transactions like depreciation or the fulfilment of part or all of a liability.

Do I need to record my income before it’s received?

Completeness is ensured by the materiality principle, as all material transactions should be accounted for in the financial statements. Although it’s the more complex of the two major accounting methods, accrual accounting is considered the standard accounting practice for most organizations. Using accrual accounting, companies look at both current and expected cash flows, which provides a more accurate snapshot of their financial health. As organizations scale and work towards enhancing their customer experience, they leverage multiple payment methods and payment terms, which makes revenue recognition all the more complex. How and when organizations record revenues and expenses is extremely crucial to get an accurate picture of an organization’s financial position. Companies that use accrual accounting sell on credit, so projects that provide revenue streams over a long period affect the company’s financial condition at the point of transaction.

Managing Vacation Accrual: Methods, Calculations, and Policies

For example, let’s say a client requests a service on April 30th but does not make a cash payment until May 30th. With cash accounting, the revenue generated for the service will not be recognized until cash is received on May 30th. Businesses that use the accrual method of accounting will maintain their ledgers to reflect the current status of an invoice or bill at any given time. For example, you would record the date when you provided a service in your accounting journal, add the date you sent the invoice to the client, and note when the invoice is paid. The three accounting methods are cash basis of accounting, accrual basis of accounting, and a hybrid of the two called modified cash basis of accounting.

Thus, the “bottom line” of a profit and loss A/C is either a net profit or a net loss. Capital Expenditures are-treated as assets, and they do not form a part of the expenses. Depreciation is a way of matching the cost of a fixed asset with the revenue (or other economic benefits) it generates over its useful life. Without depreciation, the entire cost of a fixed asset would be recognized in the year of purchase. IFRS is a standards-based approach that is used internationally, while GAAP is a rules-based system used primarily in the U.S. IFRS is seen as a more dynamic platform that is regularly being revised in response to an ever-changing financial environment, while GAAP is more static.

Part 2: Your Current Nest Egg

Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Accounting principles also help mitigate accounting fraud by increasing transparency and allowing red flags to be identified. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

For 2024, small business taxpayers with average annual gross receipts of $30 million or less in the prior three-year period can use it. The three accounting methods are cash basis accounting, accrual accounting and modified cash basis accounting, which combines cash and accrual accounting. When accounting principles allow a choice among multiple methods, a company should apply the same accounting method over time or disclose the change in its accounting method in the footnotes of the financial statements. Accrual accounting is a system used by companies to record their financial transactions at the point when they occur, regardless of when a cash transfer is made. It is unlike cash accounting, under which a transaction is deemed valid for recording when cash is actually received or paid.

Explore effective strategies for managing vacation accrual, including methods, calculations, and policy adjustments for diverse workforce needs. Some of these indirect expenses may not have been paid by the end of that month, despite being accrued in that period. This principle, in fact, relates to expenses that are not specifically related to the source of revenue, but which are incurred by the business for its existence or general conduct. ‘Duality’ refers to the fact that every transaction has a ‘dual aspect’ and therefore requires the use of ‘double entry’ accounting.

All of this can be explained by considering the transaction that was included in the discussion on accruals. This was that Andrea agrees to buy goods from Brian on 25 January and Brian agrees that Andrea can wait until 25 March to pay for the goods. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.