The automation requires the installation of a new machine which would cost $15,000 to purchase and install. This new machine can reduce annual labor cost by $4,200 and has a useful life of approximately 15 years. If present value of cash inflows is greater than the present value of the cash outflows, the net present value is said to be positive and the investment proposal is considered to be acceptable.

Download CFI’s Free Net Present Value (NPV) Template

Learn more about NPV and risk assessment today to get the most out of your investments. However, your business may have other factors to consider before accepting a project. For example, compare the NPV of two projects and choose the one with the higher return.

Net present value (NPV) method

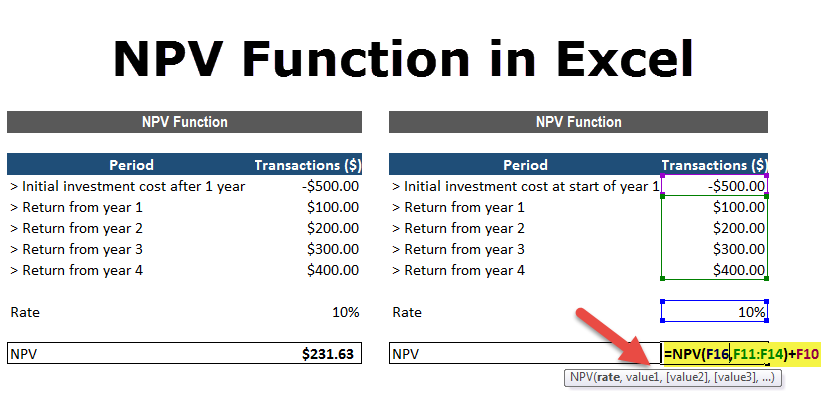

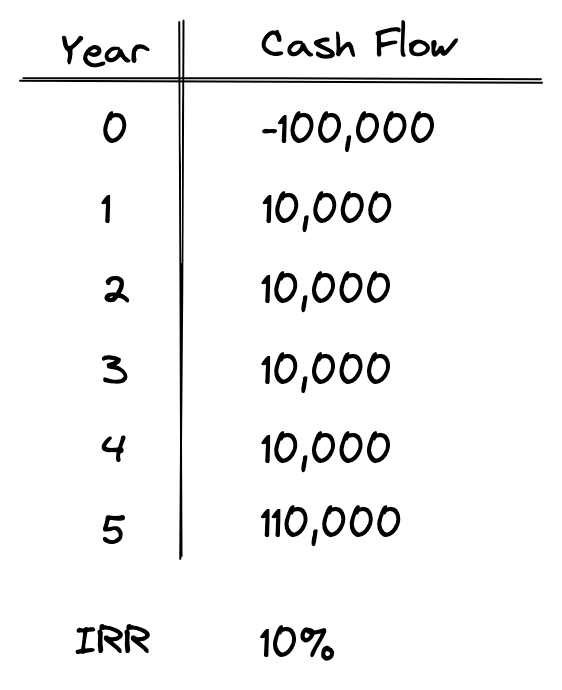

Net Present Value (NPV) and Internal Rate of Return (IRR) are two commonly used metrics for measuring the potential returns of an investment. While the two calculations share some similarities, they have essential differences. Although NPV is a helpful tool for measuring the potential return on investment, some challenges should be considered when making decisions. The main use of the NPV formula is in Discounted Cash Flow (DCF) modeling in Excel.

What is your current financial priority?

Your business’s net present value (NPV) measures its future cash flows compared to the initial investment. By analyzing an NP calculation, you can determine whether a proposed project will likely produce positive returns. Management can tell instantly whether a project or piece of equipment is worth pursuing by the fact that the NPV calculation is positive or negative. A positive number means the future cash flows of the project are greater than the initial cost. If the number is negative, however, the company will spend more money purchasing the equipment than the equipment will generate over its useful life. Net Present Value (NPV) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present.

Calculating Net Present Value

If present value of cash inflow is equal to present value of cash outflow, the net present value is said to be zero and the investment proposal is considered to be acceptable. Whether you’re making a big investment into your business, or looking to put investment funds into another organisation, the more information you have the better. Each of these appraisal tools provide different information that may put the investment in a better, or worse, light. In order to make sensible investment decisions, you need to look at things from as many different angles as possible.

Negative NPV

When they are even, present value can be easily calculated by using the formula for present value of annuity. However, if they are uneven, we need to calculate the present value of each individual net married filing separate status on your 2021 or 2022 tax return cash inflow separately. Net after-tax cash flows equals total cash inflow during a period, including salvage value if any, less cash outflows (including taxes) from the project during the period.

If present value of cash inflow is less than present value of cash outflow, the net present value is said to be negative and the investment proposal is rejected. The NPV method can be difficult for someone without a finance background to understand. Also, the NPV method can be problematic when available capital resources are limited. The NPV method provides a criterion for whether or not a project is a good project. It does not always provide a good solution when a company must make a choice between several acceptable projects because funds are not available to pursue them all. A project or investment with a positive NPV is implied to create positive economic value, whereas one with a negative NPV is anticipated to destroy value.

NPV allows for easy comparison of various investment alternatives or projects, helping decision-makers identify the most attractive opportunities and allocate resources accordingly. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

The project seems attractive because its net present value (NPV) is positive. This video provides another example of how to use NPV to evaluate whether a project should be accepted or rejected. In closing, the project in our example exercise is more likely to be accepted because of its positive net present value (NPV). If the net present value is positive, the likelihood of accepting the project is far greater.

- It represents the rate of return at which the project breaks even, helping to gauge its potential profitability.

- This decision is made to secure a steady income stream with lower risk compared to stocks.

- This concept is the basis for the net present value rule, which says that only investments with a positive NPV should be considered.

- This can be done by multiplying the expected cash flow by a certain percentage each year.

- When we used a 9% discount rate, the NPV of the embroidery machine project was $2,836.

- This is the foundation of working out the overall Net Present Value of a project or investment.

NPV considers essential factors such as inflation, tax rates, and the present value of future cash flows. Sam’s purchasing of the embroidery machine involves spending money today in the hopes of making more money in the future. Because the cash inflows and outflows occur in different time periods, they cannot be directly compared to each other. Instead, they must be translated into a common time period using time value of money techniques. By converting all of the cash flows that will occur from a project into present value, or current dollars, the cash inflows from the project can be compared to the cash outflows. If the cash inflows exceed the cash outflows in present value terms, the project will add value and should be accepted.